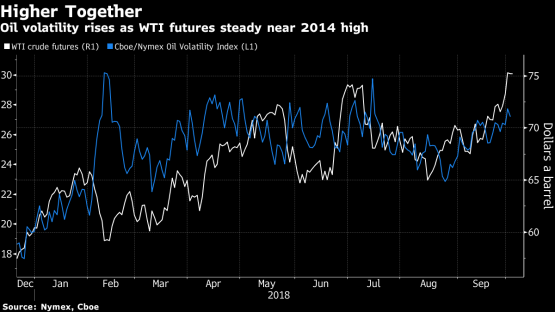

Oil steadied on the highest level in almost four years as supply crunch fears outweighed expectations to have an rise in American crude inventories.

Futures in Nyc were little changed to trade near $75 a barrel. Supply losses from Iran to Venezuela continued to rattle markets, boosting volatility and driving prices to your highest since November 2014. The continued outlook for a tightening of crude markets overshadowed forecasts to get a second weekly grow in US stockpiles.

Crude has gained much more than 20% this year on growing concerns the Organisation of Petroleum Exporting Countries as well as allies’ pledge to work more will not be enough to offset losses from American sanctions on Iranian oil. The Persian Gulf state’s exports seem to have declined by over the marketplace expected, with South Korea, Japan and India already shunning supplies ahead of the sanctions due November 4.

“There’s little doubt we have a clear uptrend,” Michael McCarthy, chief market strategist for Asia Pacific at CMC Markets in Sydney, said on the phone. In terms of expectations for people inventories, “while the market industry is expecting an increase on average, unexpected draw will be the leg up yet another level” for prices.

West Texas Intermediate for November delivery traded 7 cent higher at $75.30 at 2:34 p.m. in Singapore. The agreement closed down 0.1% Tuesday after rising into the highest close since Nov. 24, 2014 in the earlier session. Total volume traded was ready 37% within the 100-day average.

Brent for December settlement was up 9 cents at $84.89 a barrel for the London-based ICE Futures Europe exchange. Anything dropped 0.2% to $84.80 a barrel on Tuesday. The international benchmark crude traded at a $9.75 premium to WTI for a similar month.

While Opec struggles to fill the void put together by Iran and Venezuela, the talks between Saudi Arabia and Kuwait on restarting two oil fields inside a neutral zone are said to get stalled again. The start-up can result in yet another 500 000 barrels daily being produced. Currently, most Opec producers are pumping at, or all-around, full capacity, with simply Saudi Arabia capable of increase output significantly.

In united states, crude inventories are estimated to possess increased 1.5 million barrels a week ago, reported by a Bloomberg survey of 13 analysts. The responses varied widely, with one analyst forecasting a 3.65-million-barrel gain, although many others predict a decrease in 2.5 million to three million barrels. Meanwhile, the industry-funded American Petroleum Institute was believed to report stockpiles rose by 907 000 barrels a while back.

The API data also pointed with an increase at the US storage hub of Cushing, Oklahoma, of greater than Two million barrels. That might be the best net build since March if confirmed by the Energy Information Administration’s figures Wednesday.

? 2018 Bloomberg L.P