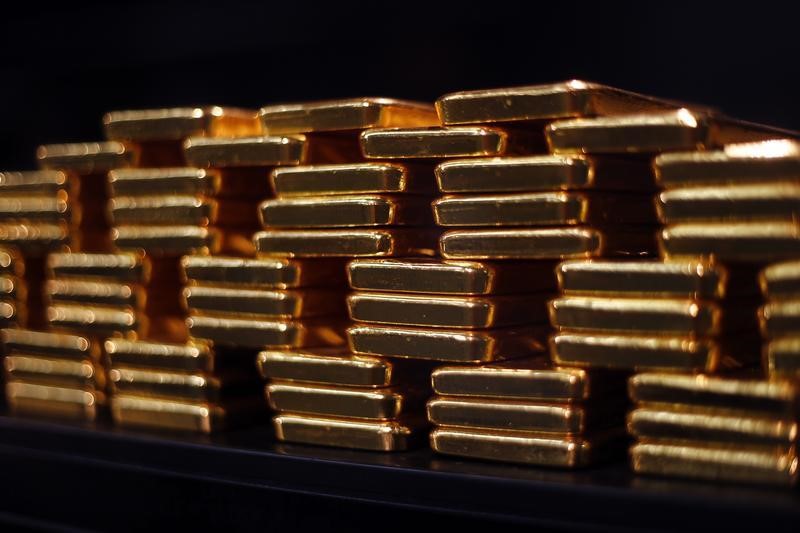

Investing.com – Gold prices pared loss to trade above break even on Friday pursuing the surge in the dollar after data showed economic growth remained robust inside third quarter pointing to underlying strength in the U.S. economy.

Gold futures for December delivery on the Comex division on the New york city Mercantile Exchange rose by $2.91, or 0.24%, to $1,272.52 a troy ounce.

Gross domestic product increased for a 3.0% annual rate within the July-September period, the Commerce Department said in the initial estimate on Friday. That had been above economists’ estimates for development of 2.5%.

The upbeat growth sparked an outburst inside the dollar and U.S. treasury yields which limited gains in gold prices amid ongoing speculation concerning President Donald Trump’s personal choice of candidate for the Fed’s top post.

President Donald Trump is leaning toward appointing Fed Governor Jerome Powell to remain next chairman of your Fed, Politico reported Thursday, citing an origin.

Gold is sensitive to moves higher in the bond yields as well as U.S. dollar – A stronger dollar makes gold more expensive for holders of foreign exchange while a boost in U.S. rates, lift the chance valuation on holding non-yielding assets for example bullion.

Gold costs are on the right track to get a second-straight week of losses amid growing optimism that upbeat economic data could persuade the Fed to take on an increasingly aggressive monetary policy outlook.

“U.S. economic news flow has markedly firmed compared to forecasts since mid-June, opening it for the upside surprise that stokes tightening bets further and compounds pressure about the rare metal,” said Ilya Spivak, commodities and currency strategist with Daily FX.

In other rare metal trade, silver futures fell 0.21% to $16.78 a troy ounce while platinum futures lost 0.79% to $914.80.

Copper traded at $3.10, down 2.41% while gas main fell by 2.93% to $2.82.